10 In 10 Contract Cheating Series – Part 7

This is the seventh in a 10 part series looking at the changing world of contract cheating that has emerged since the term was first publicised in a research paper and presentation in June 2006.

How Big Is The Essay Industry?

Although the term contract cheating was originally introduced to define the behaviour where students purchased assignments online from sites aimed at computing contractors, the term has since become synonymous with a much wider range of cheating. None of the contributors to contract cheating are more visible now than the burgeoning industry of essay writing and assignment production services, which state that they will deliver bespoke assessments to students, which can be submitted to beat any text matching software designed to detect plagiarism.

In this post, I want to look at how the current shape of this ever-changing essay industry and some of the mechanisms through which this can be estimated.

There are many estimates out there about just how big the essay industry is, including those circulated by the cheating industry itself.

The most common figure I’ve seen in 2016 has been that the essay industry raises £200 million GBP of annual revenue. That’s based on figures quoted by UK Essays owner Barclay Littlewood, dating back to interpolation following a 2006 interview that he gave to Guardian. I tend to use the phrase “tens of millions” for media work, but I have also spoken about the £200 million GBP figure, which has no doubt helped to lend it some credibility.

Other estimates are still alarming, but fall below £200 million GBP. In their 2014 paper “The Essay Industry“, Owings and Nelson calculated a bottom-line figure of $100 million USD per year (£75 million GBP based on the exchange rate in September 2016). This estimate was based largely on observing the turnaround time of essay orders. They also suggested that the $100 million USD figure could be higher still. In several places in the paper, they used cautionary and toned down their estimate. Although I do not completely agree with all of their assumptions regarding market capacity and standard pricing, if their interpretation is to be believed, a higher worth for the paper mill industry can be suggested.

In 2016, David Burton of Essay Writer told the Daily Telegraph the industry was worth £100 million GBP a year. This is a lower figure than Barclay Littlewood is associated with, but one that still looks credible.

An overall range of between £100 million GBP and £200 million GBP is certainly believable based on these sources.

In a June 2016 interview with the Daily Telegraph, one firm claimed that the average purchase from them was for £350 GBP. Although many buyers pay less than this, the average is no doubt increased through cross-sells, further editing to a sold essay, where requests are for large documents such as dissertations and where assignments are needed faster than standard turnaround times.

Using the £350 GBP average purchase price as a base line, for a business worth £100 million GBP per year, this would indicate that over 250,000 essays were sold. For a business worth £200 million GBP per year, this would indicate sales of over 500,000 essays.

Those estimates of the scale of the essay industry may be low. They focus solely on the revenue generated through traditional essay mill style writing services.

As previous work has indicated, students also use other services to have original work produced for them, such as private tutors.

They can also outsource their assignments to agency sites, such as Freelancer and Fiverr.com and potentially pay much lower rates than £350 GBP per essay.

So, if the financial figures are to be believed, the overall money in the essay industry is likely to be higher than stated above. The number of essays sold is also likely to be substantially more.

But how realistic are these numbers? In this article, I also want to consider other data available on the Internet that can help to understand the changing shape of the essay writing industry.

How Many Sizeable Essay Mills Are Out There?

One question that can be asked is, how many major essay mills are there that are currently trading?

There are some websites that provide lists of known essay mills. But, the quality of these lists is questionable.

A quick check of standard essay mill lists reveals many sites that are no longer functional. It shows other sites clinging to outdated design principles. This suggests that these essay mills have been largely abandoned.

There are essay sites listed that just sell collections of previously written essays. Each of these essays may have been outdated or may have been sold multiple times. As these did not strictly fall within the contract cheating definition of producing original work, it would not be sensible to consider these further.

One site found on a list of essay services still offered to fax orders for original work to students. Presumably, orders from this site would then need to be retyped, or could be handed in with tell-tale footers identifying the essay writing service. That also showed that outdated lists were not useful to consider.

Having rejected the use of current online lists of essay mills, I instead developed a two stage search process.

Stage 1 – I used multiple search methods to generate a list of around 1000 candidate essay mills.

Stage 2 – I analysed the reported traffic to the site (the number of recorded visitors) to produce a manageable list of essay mills that I considered sizeable.

More specifically, I completed Stage 1 of the essay mill identification process using the following methods:

Google search – using a privae incognito search and standard terms like “buy essay” and “write essay” to identifying high ranking matches. Paid Google Adwords matches were ignored. To expand the data, the term “USA” was also added to searches, although when searched for on the UK version of Google these still showed a heavy bias to UK domains (.co.uk etc). The term “essay” was kept here, even though often alternatives, such as “assignment” may be more appropriate now in many disciplines.

Well-known sites – I included sites that I was aware of that had received a large amount of publicity through the media or through offline advertising. Notable out of this process was that UK Essay, often considered the most prominent site to the UK media, did not rank at all for the Google search terms used.

Review sites – Some high ranking search engine matches turned out to be for review sites, those sites which seem to provide comparative reviews of different essay mills to help students to make a sensible choice. In reality, these sites tend to focus on the commission payments available when a student clicks through the review and places an order. The review site list was useful though. Following the links from the review site through a manual crawling process identified several further candidates essay mills for the main pool.

Similar sites – Sites generated using the above list were augmented by searching for them using similar site services. In particular, SpyFu and Alexa.com to look for sites aimed at the same target audience.

The Stage 1 search process used cannot be considered exhaustive, as not all search terms were analysed and some sites likely rank well only to specific audiences and may be targeted through geographical location or academic subject area. Other searches ended when their seemed to be no further likelihood of useful returns. For instance, Google searches revealed small and outdated sites, linked to sub-pages on larger sites, or listed sites that did not supply bespoke essays. Likewise, the similar site searches ended when these did not seem to be yielding any fresh results. Further, no attempt was made to focus on sites relying on paid traffic, or to use social searches or video searches to identify suitable parts of the essay industry.

For Stage 2 of the process, I took the filtered and manageable list of results from Stage 1 and analysed these through Wolfram Alpha to identify if the sites had sufficient traffic to be considered. Wolfram Alpha uses several factors to estimate the number of expected site visitors. These include looking at the overall volume of traffic on the Internet (a massive number) and the Alexa rank of the site in the question. This is a not a completely foolproof process, as some sites may have just referred traffic to another site. However, this process left exactly 20 sites of different sizes to be considered – a manageable number.

Analysing Visits To 20 Sizeable Essay Mills

The table below shows the 20 websites identified as sizeable, sorted from the most visits to the most visits.

There is a substantial difference in size between the sites, with the front-runner, UK Essays, supplying 78.7% of the total hits per month and 83.0% of the total unique visitors. UK Essays also had a much higher Alexa rank than the other sites identified. However, it does need to be stressed again that other high performing sites may be missing from the analysis, particularly including the equivalent of UK Essays in various non-UK markets.

| hits per day | visits per day | Alexa rank | |

| ukessays.com | 230000 | 160000 | 30707 |

| ultius.com | 12000 | 6100 | 476259 |

| oxbridgeessays.com | 6000 | 5000 | 653796 |

| essay.uk.com | 5500 | 5000 | 665702 |

| AustralianWritings.com | 8000 | 2900 | 811333 |

| NinjaEssays.com | 8600 | 2900 | 819205 |

| superiorpapers.com | 3900 | 3600 | 905436 |

| affordablepapers.com | 4700 | 1200 | 1508607 |

| unemployedprofessors.com | 2700 | 890 | 1967075 |

| grademiners.co.uk | 2100 | 1100 | 2045010 |

| speedyessay.co.uk | 1100 | 1100 | 2231936 |

| essayavenue.co.uk | 1900 | 640 | 2703989 |

| essaylab.org | 720 | 720 | 3194829 |

| smartwritingservice.com | 1600 | 320 | 3859536 |

| essaytigers.co.uk | 500 | 500 | 4138470 |

| essayempire.co.uk | 720 | 360 | 4475596 |

| rushessay.com | 1700 | 140 | 5547748 |

| buyessayonline.org | 430 | 140 | 6233956 |

| bestessay.com | 220 | 220 | 6510717 |

| royalessays.co.uk | 36 | 36 | 8520884 |

| totals | 292426 | 192866 |

Not of all of the traffic indicated will be from prospective customers. It may also include workers, for instance writers for the company aimed to find out what writing jobs are available and return the results.

Analysing Historical Changes To Online Essay Mill Visits

Rank2Traffic.com is a useful web property to visits to find out how the size of sites have changed over time.

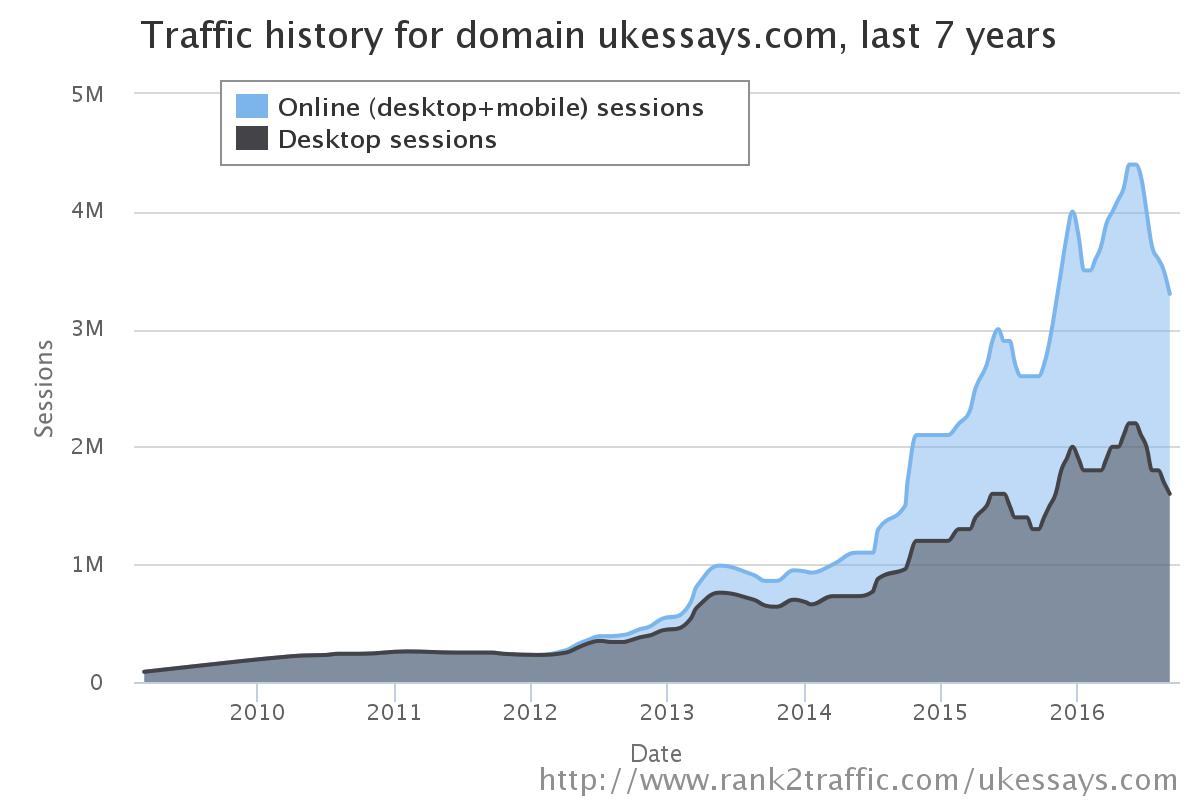

The graph below, from Rank2Traffic.com, shows the past 7 years traffic history for UK Essays, including noting a substantial growth of the number of people accessing the site using mobile devices.

The data suggests that UK Essays has seen substantial growth since 2012. There are also noticeable traffic peaks in recent years around December and June time, presumably coinciding with UK coursework deadlines. Note that the Rank2Traffic.com data shows hits per month, compared to hits per day in the Wolfram Alpha data above and the traffic estimation methods used.

Basing further analysis solely on the shape of the graph, this suggests around a 10 times increase in overall UK Essays traffic between mid 2012 and mid 2016, or a 5 times increase if only desktop traffic is taken into account.

UK Essays itself claimed a 10% increase in business year-on-year in a June 2016 interview with the Daily Telegraph. They also claimed that they had 50 full time staff, including 20 people working in quality control and a full team of offsite freelance writers. This suggests a booming business, albeit one where the percentage of visitors to the UK Essays site who are buying original assignments is also declining. The large increase in the number of visitors using mobile devices may also be contributing to what appears to be a reduction in conversion rates.

One large group of essay writing sites attempting to attract affiliates suggests that the traffic they send will convert at 8%. That seems high, but may be true for that particular audience (the so-called warm traffic who have already been convinced to buy an essay by the referring site).

UK Essays themselves suggest that they had 16,000 paying customers in 2015. It is not clear if repeat customers are included within this calculation, or if there are further orders that need to be added to that total. This should equate to them making around 50 sales per day in 2016 if the business growth is consistent with what they have stated in previous years. Comparing this figure to the 160,000 visits per day estimated by Wolfram Alpha suggests that their conversion rate is 0.031% – a much lower conversion than the 8% suggested elsewhere.

I suspect that the conversion rate on a standard essay mill lies somewhere between the figures, but this is most likely nearer the lower end than the upper end, particularly where traffic is not pre-sold and closely targeted.

It may be interesting to consider that, even if conversion was only at 0.031% across the 20 sites selected, the traffic levels stated would indicate 21,823 sales per year across the 20 sites in the sample.

A standard price of £350 GBP per essay through this route would also suggest total business revenue of just £8 million GBP per year.

Both of the figures for the number of essays sold and the amount of revenue going through the industry are still substantial, but they are way below the values typically quoted in the media. It may be that the media figures are being inflated to make the industry seem more substantial than it is.

Thoughts About The Size Of The Essay Industry

The figures and estimates used in this article are crude and allow elements of this post have a scientific grounding, the estimates cannot be considered complete or scientific.

There is scope for a more thorough and scientific analysis of the shape of the essay industry.

For this to be more complete, this needs to analyse the different routes that students can use to get assignments produced for them and the typical size of orders through those routes. The pricing models used in the essay industry are varied and my feeling is that this will show a sizeable low end and higher end market for essay writing services.

A more complete method of estimating the number of large suppliers of essays is also needed, bearing in mind that many smaller websites are really just shells of larger websites (that is, they may be advertising the same supplier, but under a different name for marketing purposes).

Even my crude analysis indicates a lower bound of the size of the essay industry of £10 million GBP per year. Adding in the long-tail of essay orders through other routes, a value of £20 million GBP per year sounds likely and a value of £50 million per year would still fall within sensible scientific boundaries. But estimates of £100 million GBP per year and £200 million GBP per year look unlikely (and the idea that the business was at £200 million GBP in 2006 looks ludricious.

I’m happy to stick with my preferred quote that the essay market is annually selling “tens of millions”.

This article is part of a series of posts looking at the developments in contract cheating over the past 10 years. Take a look at the other parts of the 10 in 10 contract cheating series.

It has taken a spike in 2016.